Steering Clear of 'House Poor': Insights From A First-Time Buyer

/Ad - Sponsored Post

Buying your first home is an exciting but daunting experience. As first-time buyers, my now-husband and I wanted to ensure we didn’t fall into the ‘house poor’ trap. Here’s how we avoided the pitfalls to ensure we retained financial security.

Avoiding The 'House Poor' Trap

Although we were both diligent savers, having deposited money into both of our Lifetime ISAs for years, we wanted to ensure that the homes we were looking at didn’t stretch our budget.

Bombshell! Just because a bank will loan you X amount of money for a house doesn’t mean that maxing out your mortgage is a good idea for you and your budget.

Yes, the house will appreciate in value. Yes, you might get a bigger, nicer home in a good area.

But if you’re just about managing to pay your mortgage, council tax, energy bill, phone, internet, food with not much left over, you’re now in ‘house poor’ territory.

Ideally, although your mortgage will likely be your largest bill, it won’t be so large that you feel like you're suffocating under the weight of that monthly payment.

So you’ve seen a house you like but you’re not sure what your monthly payment will be and how much interest rate you really might be paying over the full length of the mortgage. That’s where a mortgage calculator comes in.

How To Use This Mortgage Calculator

Enter Home Price - The price you (and your bank) will need to pay the seller

Enter Deposit - How much you can put down as collateral

Mortgage Amount - Auto-calculated (Home Price Minus Deposit)

Enter Interest Rate - The interest rate on your mortgage

Enter Term - How long until you the mortgage is paid off, not including overpayments

The Importance Of A Larger Deposit

The more you can put down on your home, the better. Not only is it less risky for you, you’ll actually increase the chance your mortgage application will be approved.

Think of it this way. If you were to put 0% down on your home, both you and the bank would be taking on more risk.

If your home drops in value, even slightly, you’re now underwater on your mortgage. You’re in negative equity territory. That means if you were to sell the home, you wouldn’t be able to pay off the whole mortgage, you’d need to pay the difference.

That puts the bank at greater risk as it means you might not be able to pay off your mortgage if circumstances mean you have to sell.

Now imagine if you’ve got a couple that puts down 30%. The house would have to drop in value by that amount before you hit negative equity. A larger deposit also reduces the amount you’ll pay on a monthly basis.

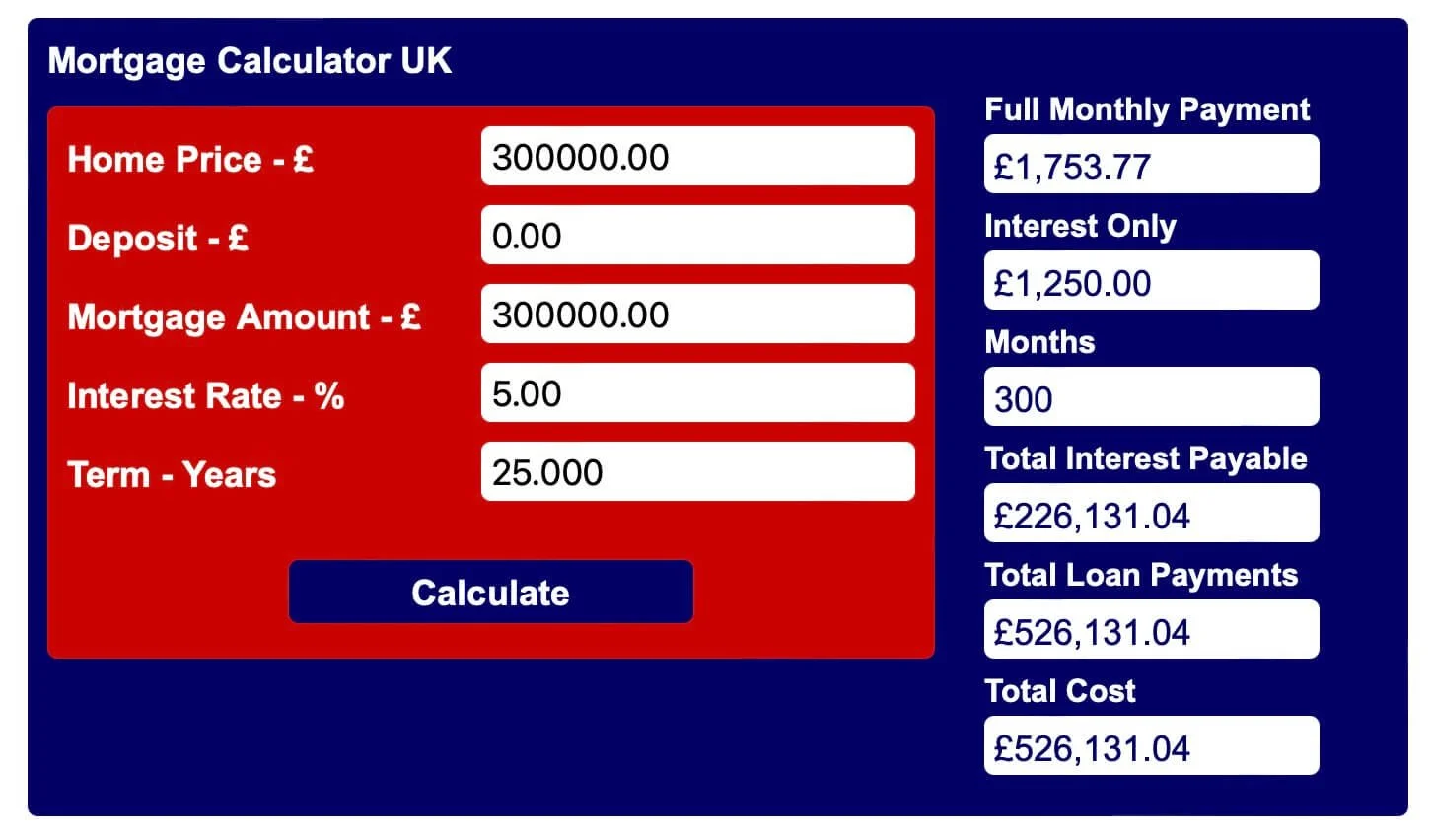

Compare the 2 scenarios below. Having a large deposit reduces the monthly payment by £583 and the total interest paid by £75K.

My husband and I managed to put down a healthy deposit. We saved a lot into both of our Lifetime ISAs for years and we saved outside of our LISAs too.

Trust me when I say, you’ll sleep better in a house that you own more of from day 1!

Know Your LTV

A lot of things that factor into your mortgage interest rate are out of your control, like the Bank of England base rate and the state of the UK economy.

However, one big factor that you can control is your LTV (Loan To Value). The bigger deposit you have as a percentage of the home’s value, the lower your LTV.

The lower your LTV, the better the interest rate is likely to be. You’ll usually see the rate go down as your LTV moves down into the next 5% band (95%, 90%, 85% and so on).

The best interest rates are reserved for those with a 60% LTV or lower. That means a 40% deposit.

We compared interest rates with a lot of banks and we found that they differed in terms of how the LTV would affect the rate. Some banks offered their lowest rate at 70% LTV, others at 60%.

Some banks would only show interest rate drops in 10% increments, rather than 5%. It really depends. But, in general, the more your deposit as a percentage of the home’s value, the lower your rate will be.

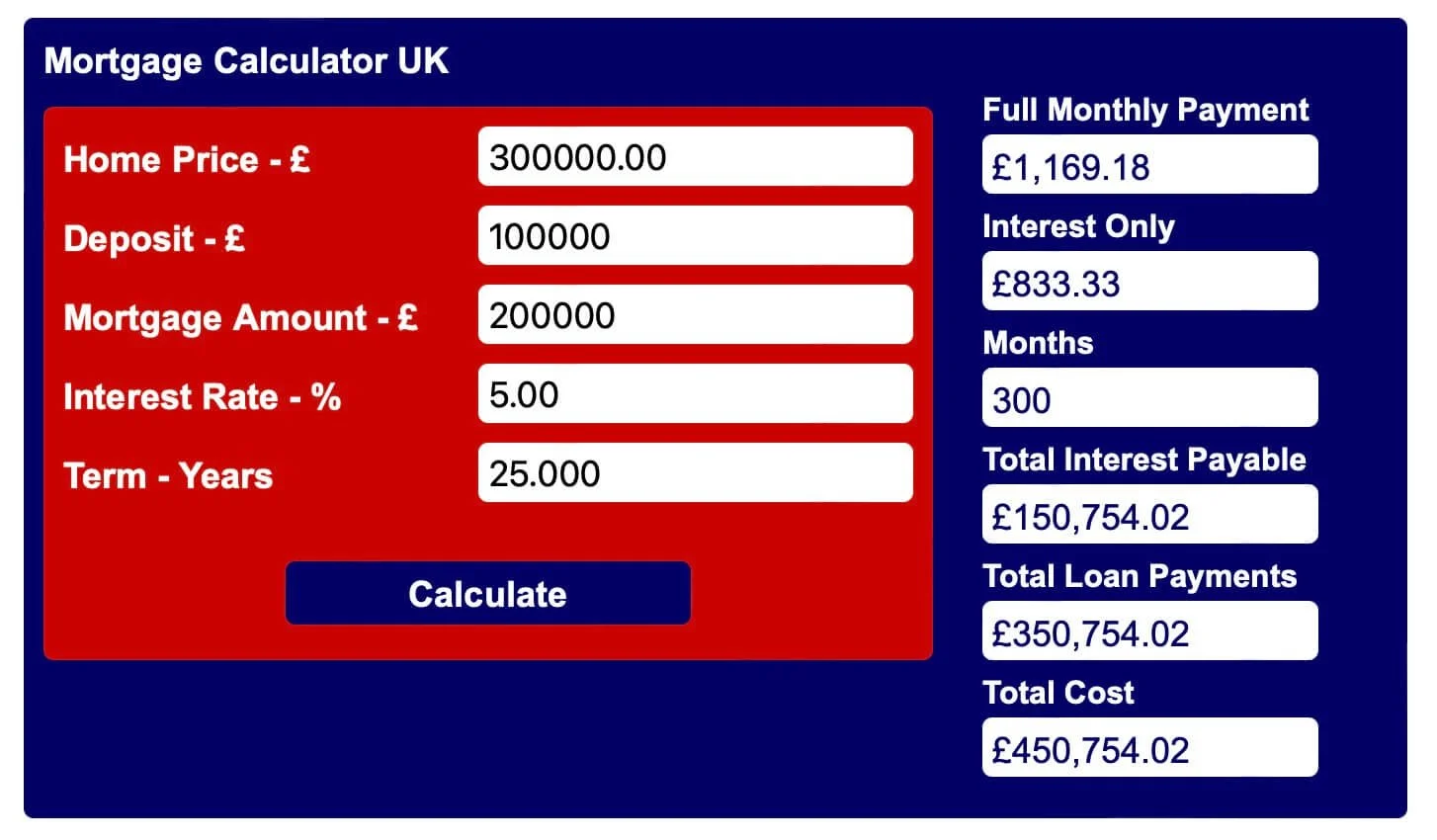

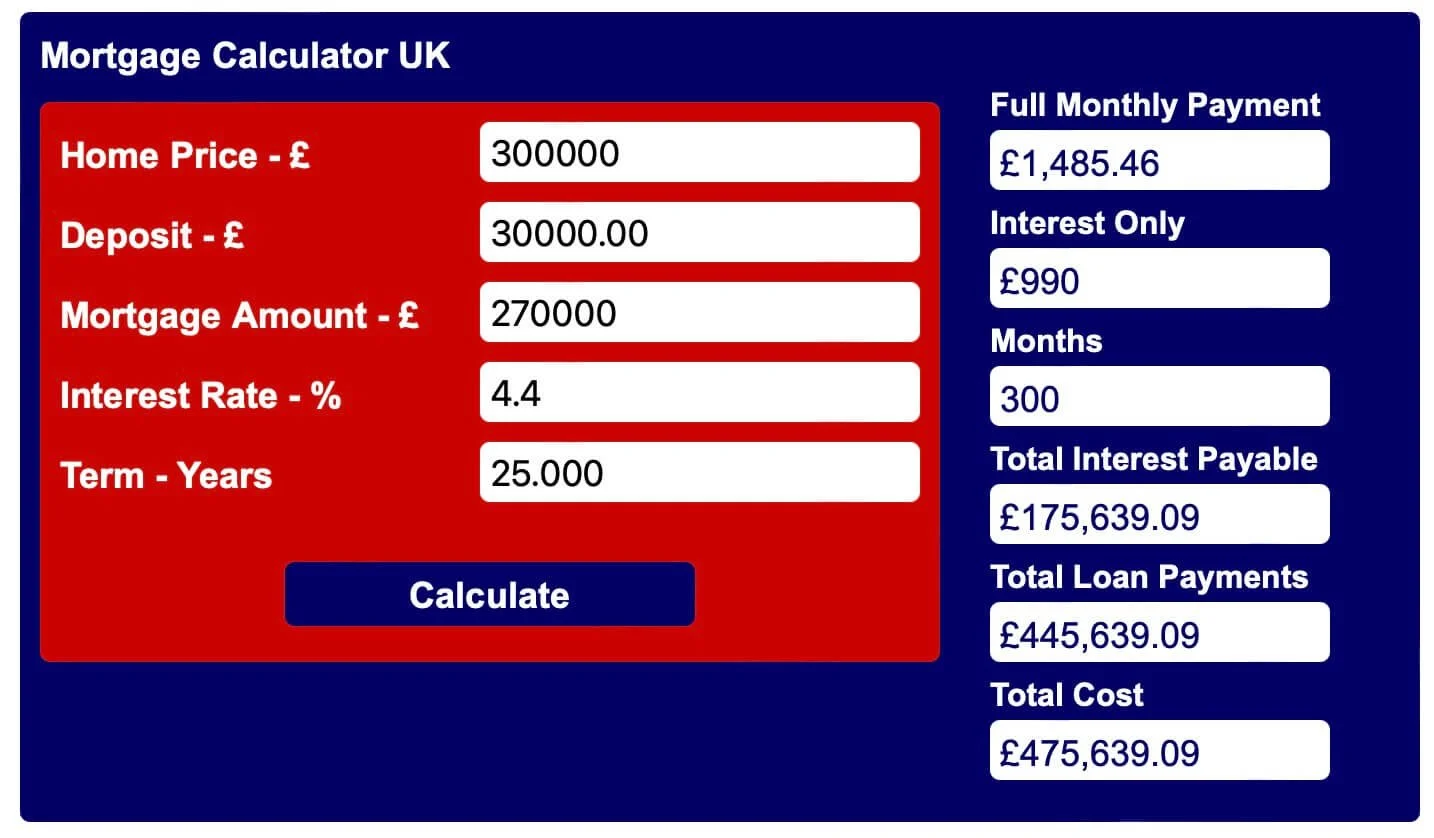

Remember, when it comes to a mortgage, even a 0.1% difference in rate can make a big difference. Compare the two scenarios below.

In this scenario, having a 4.5% interest rate rather than 4.4% would mean you pay £4,585 more in interest and your monthly payment would be £15/month higher.

Should I Go Long?

Your mortgage term is simply the amount of time you have before your mortgage is fully paid off, assuming you’re not overpaying to reduce the term (which I would highly recommend).

The longer your mortgage term, in general, the more likely you are to be approved for your mortgage since your monthly payments will be lower.

I say “in general” because there are some circumstances where you might struggle to get a mortgage with a longer term. Most notably if your likely retirement age goes past the end date of the mortgage (banks don’t like that).

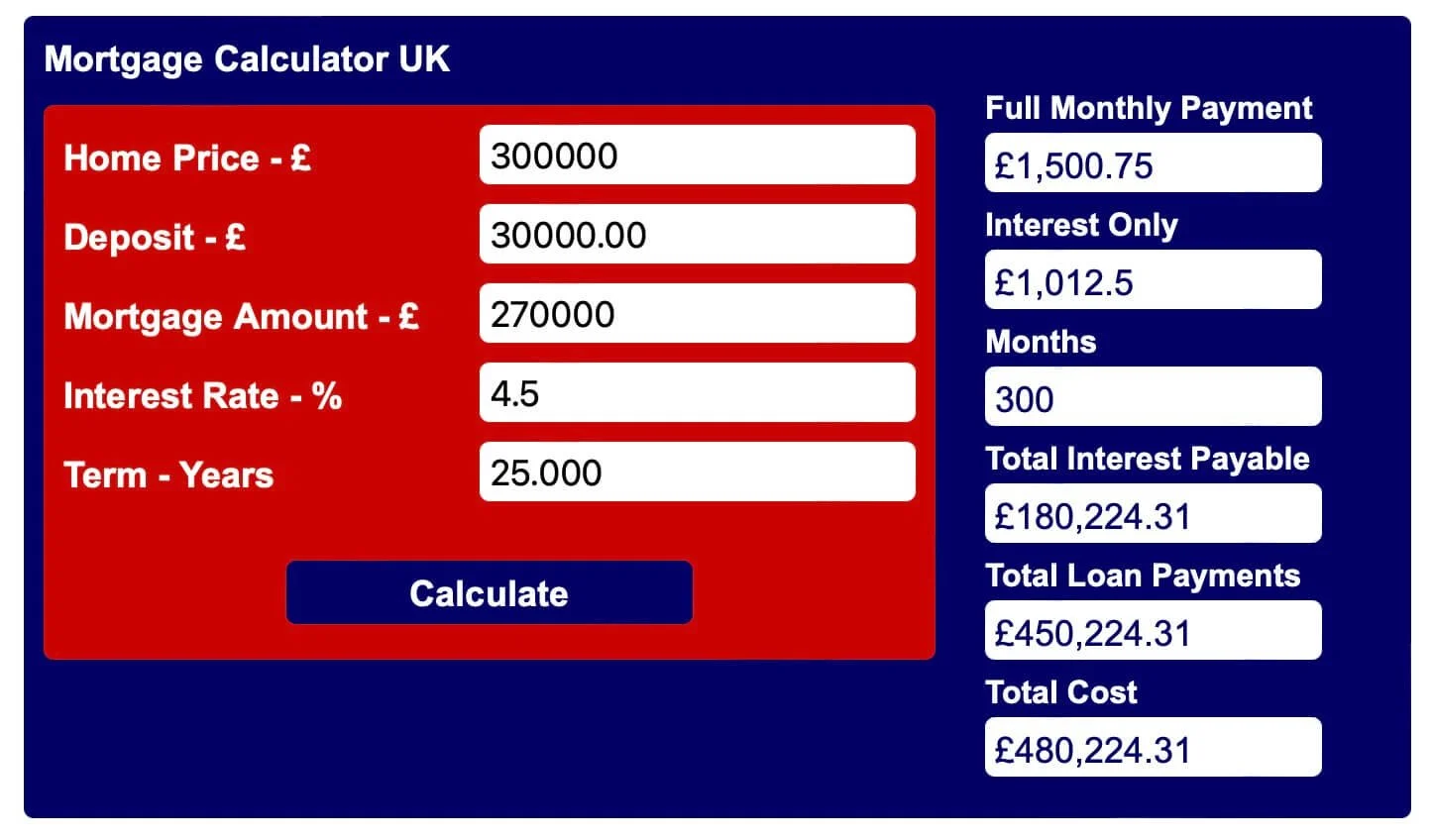

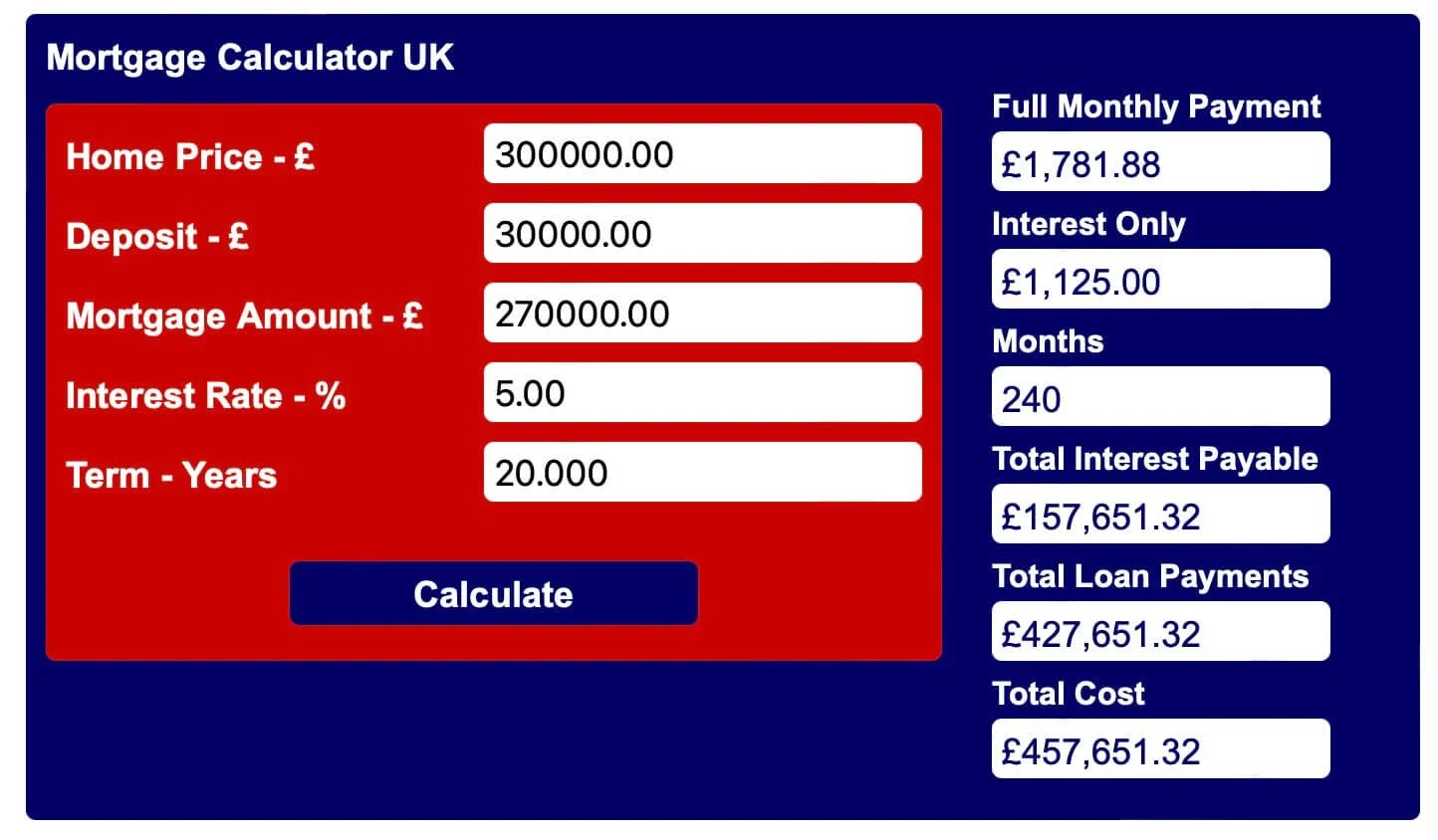

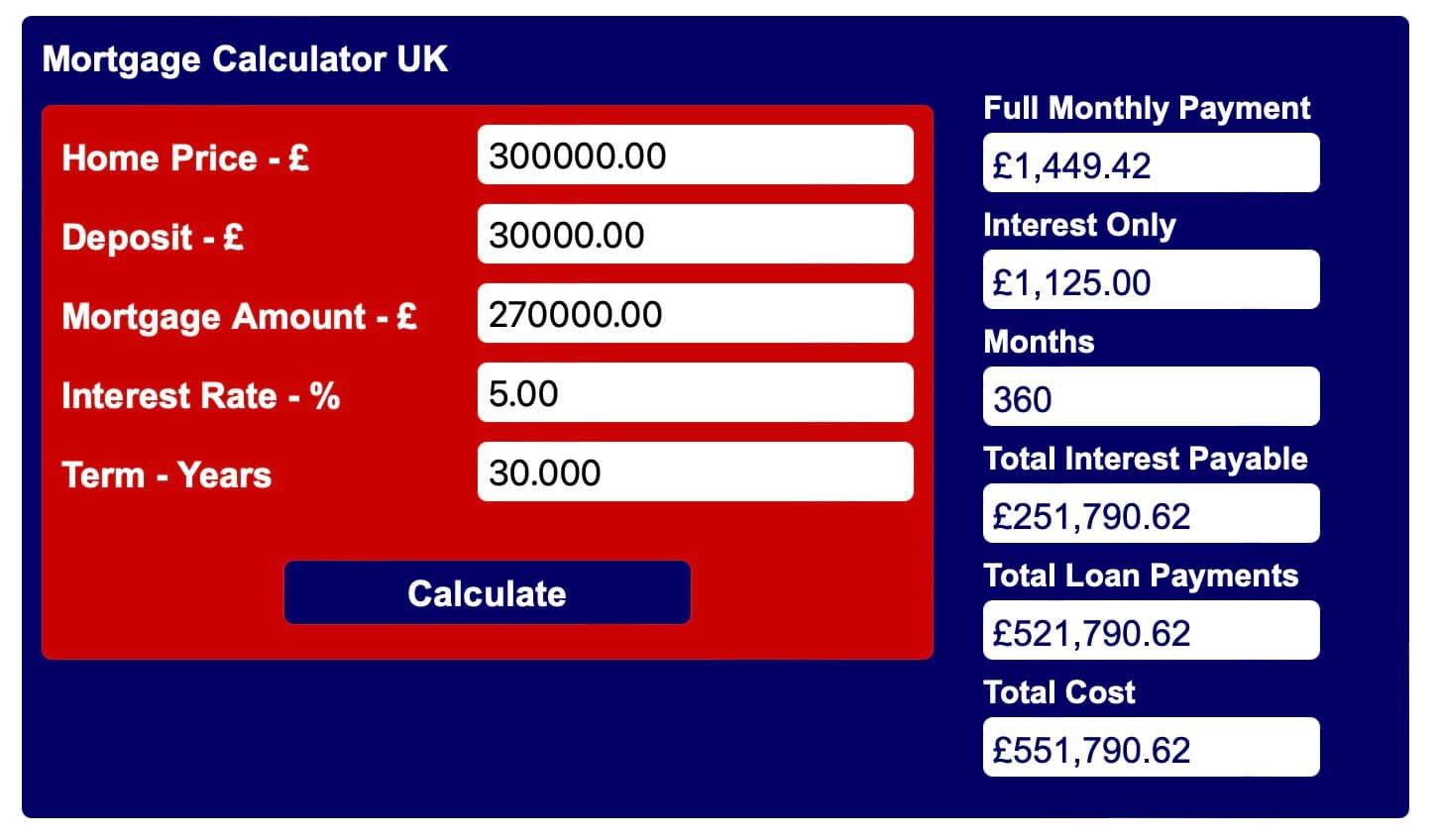

The downside of a longer mortgage term is that you’ll pay more interest if you don’t overpay. Compare the two scenarios below.

In this case, having a 30 rather than 20 year term will mean you pay £332/month less. However, you will pay substantially more interest (£94,139 more!) with the longer term.

My husband and I, who had more unusual circumstances at the time, got a 30 year mortgage term. However, we’re aiming to pay it off a whole lot quicker than that by overpaying our mortgage.

Going with a shorter term effectively forces you to do that overpayment each month, a good idea for some.

Do A Budget (And Stick To It!)

Before you buy a house, do a mock budget where you list all your income and expenses.

A zero-based budget is best if you can. That simply means giving each British Pound you have coming in gainful employment. No slackers!

Some of your pounds will be put towards fixed expenses, like your mortgage, council tax, energy bill etc. Others will be put towards variable expenses like food, fuel, entertainment.

Hopefully, you’ll have some workers left sitting on the sidelines. Give them a job too! Whether it’s to invest for the future, save for a car, holiday or a new TV.

A budget, done properly, won’t feel restrictive. It will feel freeing. You’ll know you can afford to pay the necessities and you won’t feel guilty spending your holiday fund on a trip abroad.

You’ll want to make sure your projected mortgage payment doesn’t take up too much of a percentage of your household take home pay. You don’t want to be house poor.

Keep Using A Mortgage Calculator

Once you’ve budgeted for your mortgage payment, use that to determine the maximum home you can actually afford.

Not the amount the banks tell you that you can afford, the amount you can actually afford whilst balancing that with your short and long-term goals.

Whenever we found a property we were interested in buying, we’d plug the price into a calculator, enter our updated deposit amount and the best interest rate we could get at the time.

We used that to determine whether that house was actually affordable or whether it was out of our price range.