Control Your Spending With Amex Alerts

/Background - Amex Benefits

In my opinion, an American Express rewards credit card has two major benefits. Firstly, the points scheme, Amex Membership Rewards (MR), is quite generous. You can use MR points for gift vouchers, statement credit (to pay off your own purchases) or you can convert them to other rewards schemes.

‘American Express Offers’ is the other major benefit. Amex offers cashback or MR points if you use your card on purchases from certain retailers. These offers change all the time and there are plenty of them.

Facilitated Spending With Credit Cards

Of course, whilst credit cards can save you money (through cashback/rewards) they can encourage you to spend more, effectively costing you. Studies published since around the 1960s highlighted the idea of “facilitated spending”.

A primary factor driving users to spend more with plastic is the “buy now, pay later” mentality. If you make a purchase on your credit card, you are not billed until the end of the month. This time delay between purchasing and paying has a significant impact on consumer behaviour.

The more detached we are from our purchases, the more likely we are to spend. Whilst I love and greatly rely on technology, I believe that the invention of Apple Pay and Android Pay will have a similar effect. You no longer need to reach for your wallet or your purse to make a payment on the go, just your phone. This further detaches you from your spending, which can drive you to pay for things without thinking.

What Is The Solution?

I don’t believe the solution is cutting up your credit cards. Instead, I believe the answer is two-fold. You must be conscious of “facilitated spending” and you must use an active strategy to mitigate it. Knowing that detachment from your spending can increase it, a ‘reattachment’ strategy can help control your spending.

Do you know, even roughly, your credit card balance at this moment? Have a guess and then go and find out how accurate you are. If you are not satisfied with your accuracy, then you might be suffering from spending detachment. As highlighted above, this is probably a bad idea.

Amex Notifications Through The App

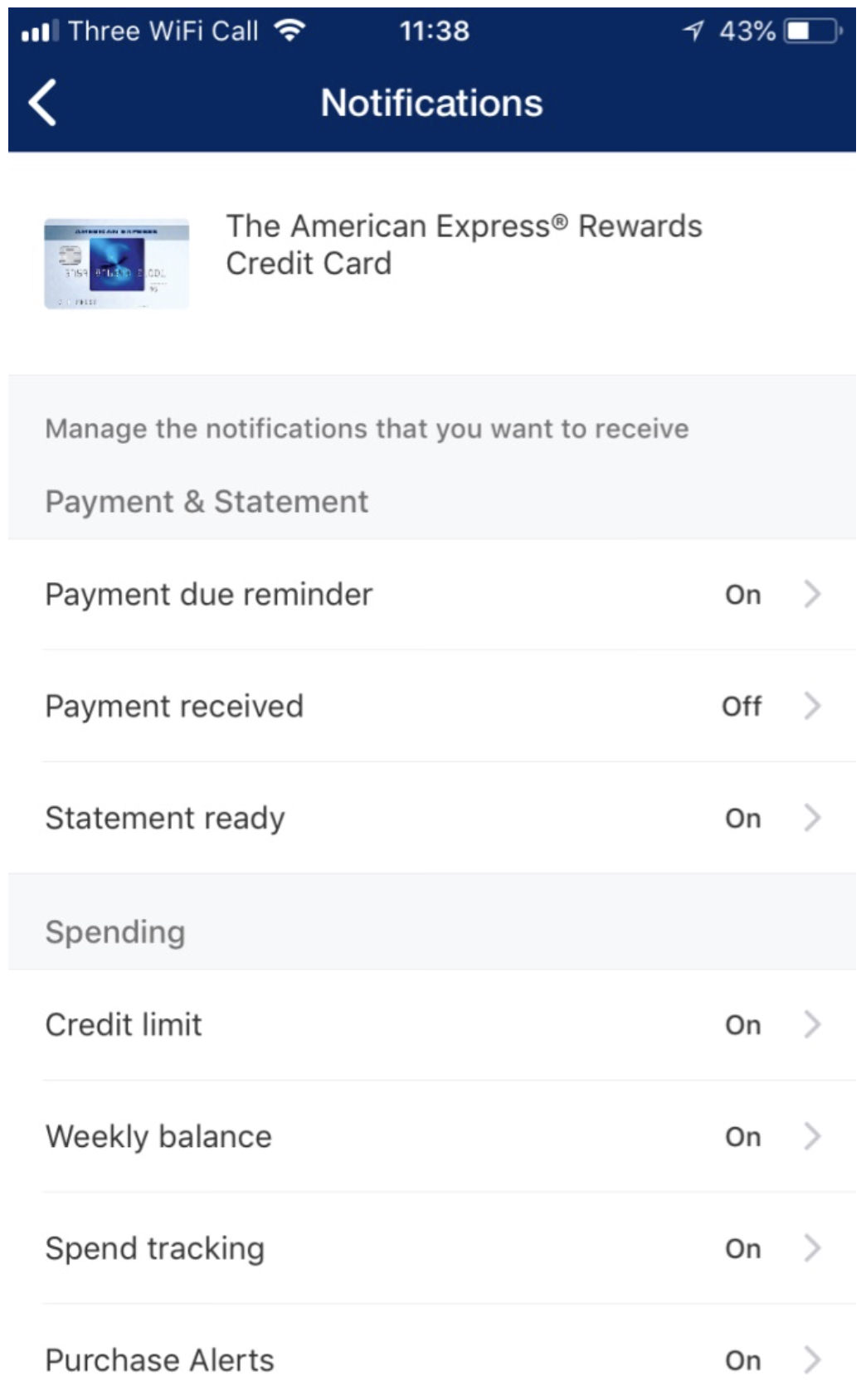

This is where Amex notifications come into play. You can use these notifications to force observation of your spending, which should help you control it. If you have an Amex card and a smartphone, make sure you have downloaded and set up the Amex app.

Once this step is complete, go to the ‘Account’ tab. Now open ‘Notifications’ (under settings). In this section you have a number of options. I am going to focus on the ‘Spending’ sub-section.

Weekly Balance

With this enabled, every week you will receive a notification consisting of your statement balance. You can select the day you wish to be notified on.

Purchase Alerts

If you enable this feature, you will be notified as soon as you make a purchase. Currently, contactless purchases may not notify you (as they are not processed in real-time). Most of the payments I make are contactless so I am hoping this feature will eventually be implemented. However, purchase alerts are more for security than tracking.

Credit Limit

If you select to turn on this option, you will be notified when your balance is within a certain amount of your credit limit. I set this at around 80% of my credit limit so that I get a notification if I have spent over 20%. I aim to keep all spending below 30% every month as a low credit utilisation ratio is important for building your credit score.

Spend Tracking

This is really the same as the “credit limit” option. I set this at 10% of my credit limit, therefore I am notified when I reach both 10% and 20% utilisation (with the credit limit notification enabled). The more you are notified the better.

Enable All of These

I enable all of these so I am consistently made aware of my statement balance/credit utilisation etc. Notifications allow you to keep track of your balance without having to actively seek out the information. This will facilitate control over your spending.

Card Alerts Using The Web Interface

An alternative ‘Card Alerts’ notification system can be accessed when you login to your Amex account online. Under “My Account”, go to “Profile and Preferences” and select the “Card Alerts” tab. In this section you can set up e-mail or text notifications which are separate from those offered by the Amex app.

The Spending Alert options you have using this interface are:

Card Limit

The same as above. You can choose to receive an alert when your balance is within a certain amount of your credit limit. Again, I set this at 80% of the limit, so I receive a notification when I hit 20% credit card utilisation.

Balance Update

A weekly balance update sent on your day of choice.

Spend Tracking

Receive an alert when your spending reaches the value of your choice, within a billing period.

I Opt For Double Amex Notifications

In all cases I opted for the e-mail notifications. I disabled text alerts because I already have the Amex app notifications enabled. In essence I receive the same alerts in two forms. This is so I am made aware of them when I open my phone and/or e-mail.

Enabling all of these notifications can help 'reattach' you to your spending and keep you more conscious of your account balance.

If you liked this post, hit the like button down below. If you want to contribute to the discussion you can do so in the comments section down below.

The best UK Viaplay Sports (prev. Premier Sports) Deals, Trials and Savings that you’ll find in May 2025. Updated throughout the month.